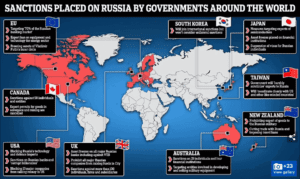

How Western Sanctions Are Reshaping Russia’s Economic Future

Technology Restrictions

Western sanctions have limited Russia’s access to advanced technologies and components, including semiconductors, aviation components, and industrial machinery, and have crippled key industries such as defense, automotive, and telecommunications.

Key Technology Restrictions

- Semiconductors: The United States, the European Union, and others have imposed export restrictions on advanced semiconductors and microchips to Russia. Thus, Intel, TSMC, and NVIDIA stopped selling chips critical for Russia’s military systems, data centers, and AI applications.

- Software and IT Services Ban: Software providers like Microsoft, Oracle, SAP, and Adobe stopped offering cloud computing services and updates in Russia.

- Telecommunication Equipment: Telecoms like Ericsson ceased operations in Russia, delaying the development of 5G equipment.

- Consumer Technology: Companies like Apple, Samsung, and Sony halted shipments of smartphones, laptops, and others, leaving Russian consumers reliant on imports from China and other non-sanctioning nations.

- Industrial Technology: Western sanctions against Russia blocked the export of key industrial technologies, including robotics and automation systems. Consequently, ASML, a leading producer of chipmaking lithography machines, ceased operations in Russia.

- Technology Restrictions: Export controls on advanced technologies, including semiconductors, aviation components, and industrial machinery, have crippled key industries such as defense, automotive, and telecommunications.

Impacts of Technology Restrictions on Russia

- Defense and Military: The ban and restrictions on semiconductors disrupted Russia’s ability to produce advanced military systems, including precision-guided missiles, tanks, aircraft, drones, and radar systems. Therefore, Russia has resorted to repurposing components from consumer electronics for military use.

- Economic Disruption: The inability to access advanced technologies has significantly hindered Russia’s aerospace, automotive, and energy industries.

- Energy Sector: Restrictions on oil & gas extraction technologies have limited Russia’s ability to explore hard-to-reach reserves like Arctic and shale deposits. Reliance on ageing equipment and obsolete techniques has reduced efficiency.

- Automotive Industry: The exit of global automakers like Renault and the ban on chips have disrupted Russia’s domestic car production. Thus, Russian automakers like Lada have struggled to produce modern vehicles.

- Aviation: Sanctions on aircraft components and maintenance technology have grounded a significant portion of Russia’s commercial fleet. Thus, Russian Airlines like Aeroflot have been cannibalizing grounded Boeing & Airbus planes for parts.

- Loss of Innovation: The restrictions have stalled Russia’s AI, quantum computing, and software development progress as Russian startups and tech firms face difficulty accessing venture capital and technologies

Rise of Chinese Alternatives

- With Western firms exiting, Chinese tech companies like Huawei, ZTE, and Xiaomi have gained market share in Russia.

- Chinese semiconductor and microchip manufacturers have emerged as alternative suppliers, albeit with less advanced technology than their Western counterparts.

Labor Challenges

Western sanctions against Russia have worsened demographic and workforce issues:

- The war and sanctions have led to an exodus of highly skilled workers, particularly in IT, finance, and research, weakening the country’s innovation potential.

- Economic sanctions have reduced opportunities for skilled tech, finance, and science professionals. Many have emigrated to nearby countries (Georgia, Kazakhstan) or Western nations, seeking stable environments and better career prospects.

- The exodus of Western firms (tech and finance) has eliminated jobs that offer competitive salaries, innovation, and professional growth.

- Sanctions-induced ruble volatility and rising living costs have made it less attractive for professionals to stay in Russia.

- Many young professionals fled Russia to avoid being drafted into military conscription.

- The partial military mobilization in 2022 removed hundreds of thousands of men from the workforce, particularly in rural areas and industries like construction and logistics.

- Consequences: Economic decline, reduced innovation, loss of global competitiveness, and greater dependence on China for skilled labor.

Government Response

- Offering tax incentives and salary increases for IT professionals.

- Restricting emigration for key personnel in sensitive industries

- Wage subsidies and bonuses to retain workers in critical industries, such as IT and healthcare.

- Tax benefits have been offered to companies that retain or attract skilled workers.

- Reduction of visa requirements for migrants from Central Asia to fill gaps in low-skilled labor.

Geopolitical and Trade Realignments

Faced with sanctions from Western markets, Russia has turned to non-Western allies and emerging markets like China, BRICS, and the Global South.

Key Areas of Dependence on China

Western sanctions imposed on Russia have forced the country to deepen its economic and geopolitical reliance on China. As a result, the sanctions cut Russia off from Western financial systems, advanced technology, and trade partnerships, leaving it to pivot toward non-Western allies, with China emerging as the dominant partner.

- Oil and Gas Exports: China is now one of the largest Russian crude oil and gas buyers. Russia offered substantial discounts to secure Chinese buyers.

- Critical Technologies: China provides Russia with alternatives to Western technologies, including semiconductors, industrial equipment, and telecom infrastructure, after Western companies withdrew from Russia. Thus, Chinese brands like Xiaomi, Huawei, and Geely now dominate markets once led by Western companies.

- Financial Systems and Transactions: With Russian banks removed from SWIFT, China’s Cross-Border Interbank Payment System (CIPS) and the yuan are increasingly used for trade settlements. Thus, the yuan has gained prestige in Russia’s financial system, with some Russian banks now issuing yuan-denominated bonds. Also, platforms like Alipay and WeChat Pay have expanded in Russia as alternatives to Western payment systems.

- Military & Technology Collaboration: Russia depends on China in artificial intelligence, 5G networks, and microchips

- Infrastructure and Investment: China has become a key investor in Russian infrastructure projects under the Belt and Road Initiative.

Long-Term Challenges

- Loss of Diversification: Dependence on a single major trading partner leaves Russia vulnerable to shifts in Chinese policy.

- Reduced Sovereignty: Russia’s economic autonomy decreases as it becomes more reliant on Chinese capital, technology, and markets.

Expanding Ties with BRICS

In response to Western sanctions, Russia has been strengthening its relations with the BRICS nations, which include Brazil, Russia, India, China, and South Africa.

- Trade Growth: Trade volumes between Russia and BRICS nations have surged post-sanctions. China and India are major buyers of Russian energy and commodities.

- De-dollarization: Russia and its BRICS partners are working to settle trade in national currencies, especially the Chinese Yuan. Discussions are ongoing to create a BRICS currency that can challenge the US dollar.

- Expansion of BRICS: At the 2023 BRICS Summit, six new members (Saudi Arabia, UAE, Egypt, Iran, Ethiopia, and Argentina) were invited to join. This expansion increases the bloc’s geopolitical influence and enhances Russia’s access to new markets.

Strengthening Relations with the Global South

Energy Diplomacy

- Africa: Russia is positioning itself as a key oil, gas, and nuclear energy technology supplier. For example, it is working on nuclear power projects in Egypt.

- Asia: Deals with Vietnam, Indonesia, and other Southeast Asian nations are bolstering its energy exports.

Food Security Partnerships

- Fertilizers and Grains: Major exporters of fertilizers and grains to countries in Africa and Latin America.

Defense Cooperation

- Africa: Russia accounts for nearly half of Africa’s arms imports, reinforcing its influence on the continent.

Strategic and Geopolitical Implications

- Weakened Western Sanctions: Russia’s partnerships with the Global South dilute the impact of sanctions by maintaining alternative trade routes and financial systems.

- Global Power Rebalance: Russia contributes to a multipolar world order that challenges Western hegemony by aligning more closely with emerging economies.

- New Sphere of Influence: Increased collaboration with the Global South bolsters Russia’s position as a key player in Africa, Latin America, and Asia.

1 Response

[…] in Ukraine: Russia’s invasion of Ukraine in 2022 has complicated its ties with Central Asia. While these countries have not supported Western sanctions, they have also refrained from openly […]