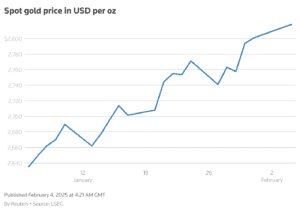

Gold Prices Hit An All-Time High of $2858.12 Per Ounce

Gold prices surged to a historic high on February 5, extending to a record $2858.12 per ounce. The rally comes as investors express concerns about a global trade war. Thus, they are seeking safe-haven assets amid US-China trade tensions.

The price of Gold surged 1% to $2858.12 per ounce before dropping to $2855.32, marking a 0.5% increase for the day. Also, US gold futures were up, closing at $2884.60, up 0.3%.

Analysts attributed the surge to escalating trade tensions between the US and China. On February 4, US President Donald Trump’s additional 10% tariffs on all Chinese imports went into effect.

China responded by restricting certain US imports, including a 15% tariff on US coal and liquefied natural gas (LNG).

In addition, it imposed a 10% tariff on crude oil, agricultural machinery, large-displacement cars, and pickup trucks, effective February 10. It also signaled potential sanctions against companies such as Google.

Gold prices have jumped more than 8% this year on fears of a global trade war, setting record highs. In London, short-term gold borrowing costs surged due to a shortage in the city’s trading markets. Traders have ramped up shipments to the US in anticipation of the impact of Trump’s tariffs.

The World Gold Council said in a February 5 report that global gold demand rose 1% to a record 4974.5 metric tons in 2024. The demand was driven by higher investment and increased central bank purchases in Q4.

The Trump administration’s plans for trade tariffs come with inflation risks.

Data showed that US job openings in December fell to 7.6 million, short of the consensus estimate of 8 million, indicating a potential economic slowdown.

Bullion is traditionally considered a hedge against inflation and geopolitical uncertainty. However, higher rates reduce the non-yielding asset’s appeal.

Apart from Gold prices hitting $2858.12 per ounce, spot silver rose 2.5% to $32.33 per ounce. Platinum gained 0.4% to $967.94, and palladium fell 1.3% to $994.