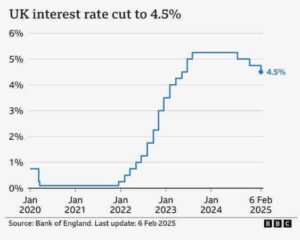

Bank of England Cuts Key Interest Rate to 4.5%

The Bank of England, on February 6, cut its base rate to 4.5% amid easing inflation.

However, it highlighted lingering risks such as weak GDP growth and potential US tariffs. Although the British pound fell, the FTSE 100 hit record highs.

The economy is now expected to grow by 0.75% in 2025, the Bank said, down from its previous estimate of 1.5%.

The Bank of England’s 25-basis-point cut in its key interest rate to 4.5% marks the third cut since August 2024.

The Bank’s Monetary Policy Committee voted 7-2 in favor of the cut – those two members wanted a bigger cut, to 4.25%

According to the Bank, the rate cut reflects progress in curbing inflation. Still, policymakers remain cautious about lingering price pressures.

Inflation Outlook: Progress, But Risks Remain

The Bank of England has cut interest rates from 4.75% to 4.5%, the lowest base rate since June 2023

The BoE noted substantial progress in lowering inflation over the past two years due to fewer external shocks and monetary tightening.

However, it warned that inflation has not entirely dissipated. Consumer price index (CPI) inflation stood at 2.5% in Q4-2024.

Also, higher energy costs and regulatory price adjustments may push CPI inflation to 3.7% by Q3-2025 before slowly returning to the 2% target.

The Bank of England also stated that monetary policy must stay restrictive for some time. The aim is to balance the risk of inflation reaccelerating with the need to support a sluggish economy.

Mortgage Impact

The interest rate cut means that for the 600,000 homeowners on mortgage tracker deals that move in line with the base rate, monthly repayments will typically fall by £29.

The nearly 700,000 people on standard variable rate mortgages will have to wait to see if their lender responds.

Those on a fixed mortgage deal will see no immediate change, but there might be cheaper deals available for new and renewing customers

However, the rate cut will likely lead to lower returns for savers.

Sluggish Economic Growth and Trade Risks

The BOE’s November Monetary Policy Report noted that the UK economy has underperformed expectations, with GDP growth weaker than forecast. Business investment and consumer confidence have eased, creating additional uncertainty about the country’s growth outlook.

However, the Bank of England expects GDP to improve from mid-2025 onwards following the rate cuts to 4.5%

Furthermore, the bank acknowledged growing risks from possible US trade tariffs, which could impact the UK’s exports and investment climate.

The United States is the UK’s second-largest trading partner after the European Union. The US accounts for 22% of gross exports – around £190 billion (€223 billion) or 7% of GDP.

While nearly 70% of UK exports to the United States are services, which would not be directly affected by goods tariffs, the BoE warned that broader trade restrictions could impact UK businesses.

The Bank also cuts its growth forecast for the UK economy in 2025 from 1.5% to 0.75%

Market reaction: Sterling Weakens, FTSE 100 Hits Record Level

The pound fell 1% against the US dollar, trading at $1.2380, marking its worst daily performance since early January.

The Euro strengthened 0.6% against sterling to 0.8365.

Also, the UK government bond yields declined, with the two-year gilt yield falling five basis points to 4.10%.

At the same time, the 10-year yield dipped 2 basis points to 4.42%.

Equity markets rallied on the rate cut, with the FTSE 100 surging 1.5% to a record 8,755 points, extending its monthly gains to 6%.